Last month, Lee and I had the pleasure of hosting an illuminating event aimed at making your homeownership dreams come true. Our commitment to helping individuals like you become proud homeowners is unwavering, and we’re thrilled to announce that this seminar was just the beginning of many more to come, spanning Ventura County and Santa Barbara County.

Our event featured the insights of two industry experts, Leanne Walker from CalHFA and Lynda Bernal from Prosperity Home Mortgage. Their knowledge proved invaluable as they shared with us some eye-opening facts and possibilities in the world of first-time homebuyer programs.

Leanne dove into the details of the CalHFA Dream For All program, which generated tremendous interest earlier this year. However, she didn’t sugarcoat it—getting into this program won’t be a cakewalk. With a lottery system in place, it’s no longer a mere race to secure a property; it’s a guarantee of loan approval for 90 days. This assurance benefits both buyers and sellers alike, as it instills confidence in the transaction.

One key advantage of the Dream For All program is the generous 20% down payment contribution, allowing buyers to stretch their budget further. But, of course, there are some stringent eligibility criteria. First, the buyers must be first-time homebuyers, meaning their parents haven’t owned a property in the last decade. Additionally, there are income and down payment restrictions.

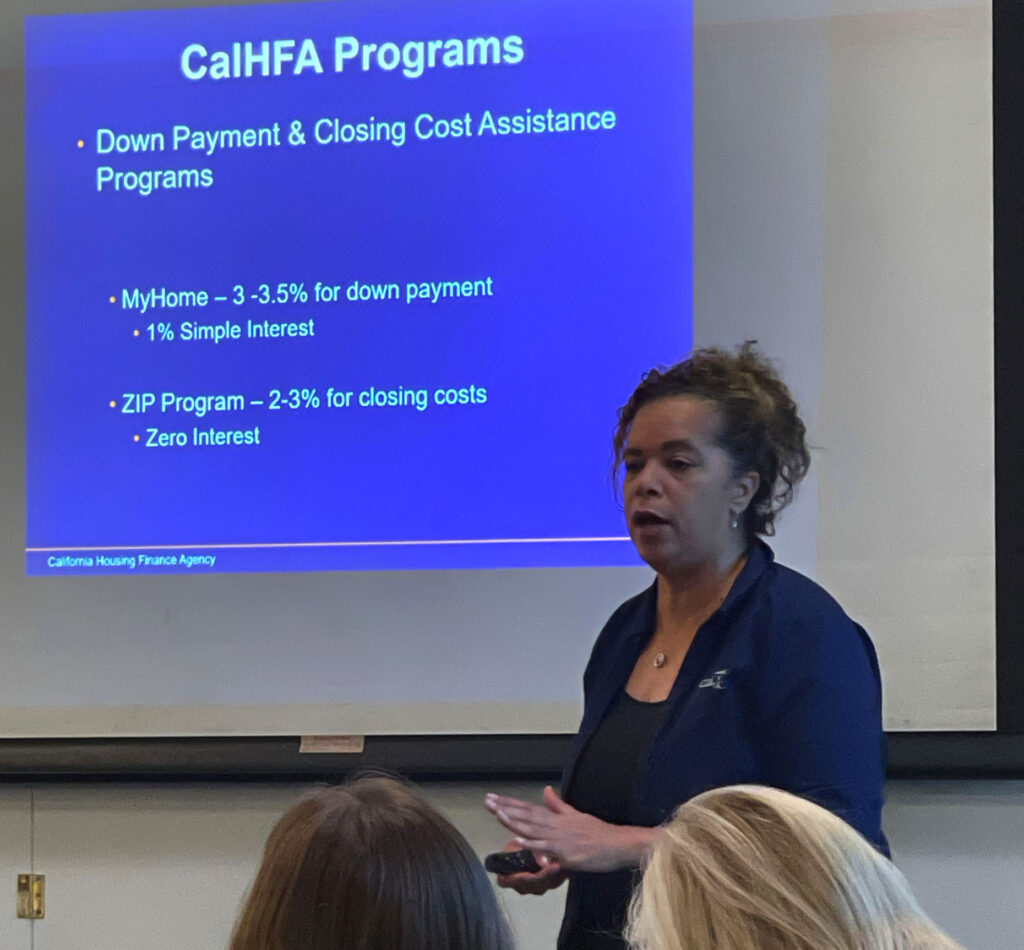

Despite the hurdles, Leanne’s enthusiasm remained unbridled. She encouraged us not to be disheartened by the challenges of the Dream For All program. CalHFA offers a treasure trove of other programs, each designed to make homeownership attainable. Leanne highlighted two standout options: the MyHome Program, providing 3-3.5% for a down payment with a 1% simple interest loan, and the Zip Program, covering 2-3% of closing costs—interest-free!

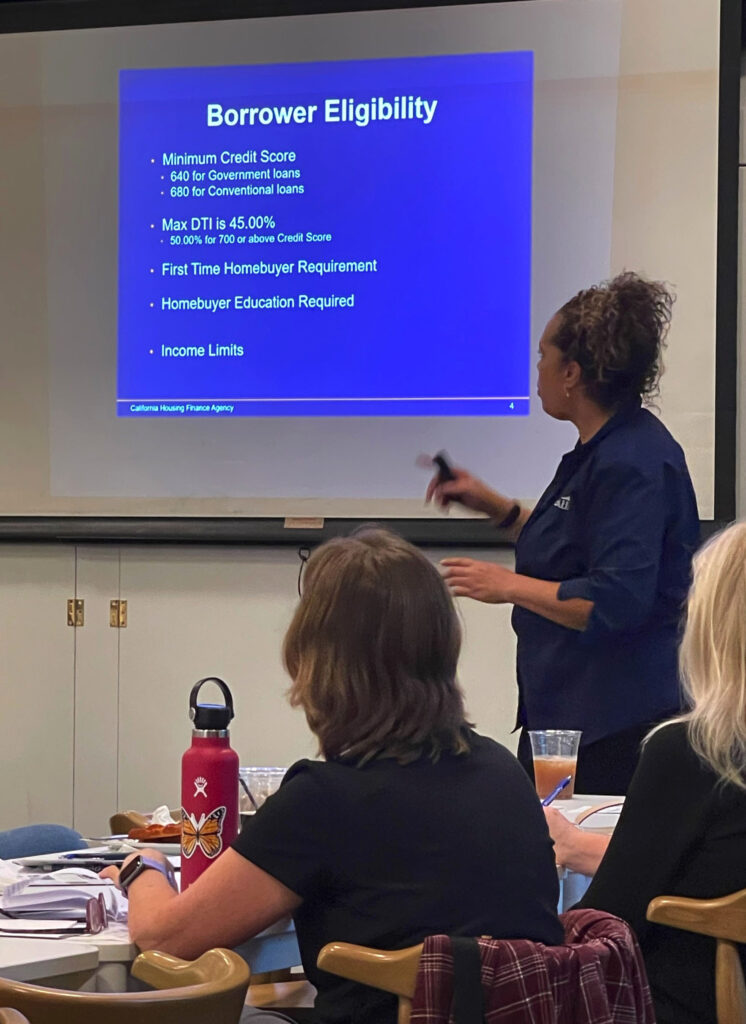

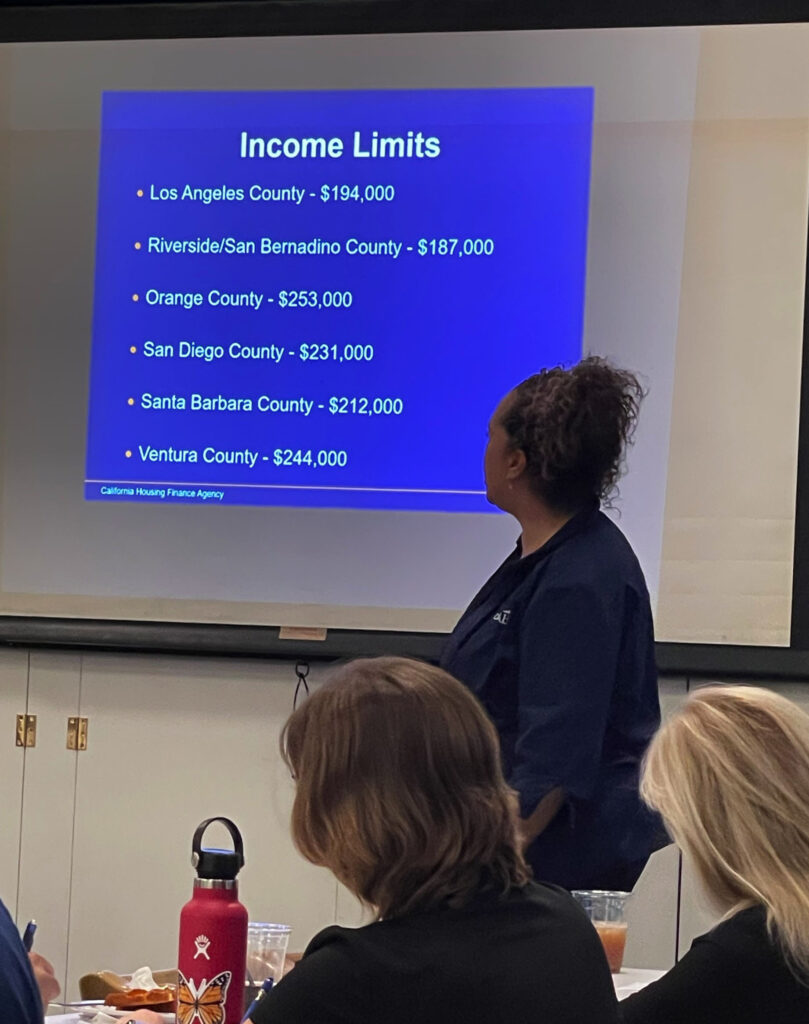

To qualify for these programs, there are certain guidelines to consider, including credit score requirements and income limits. Interestingly, “first-time homebuyer” isn’t as straightforward as it sounds. There are exceptions. For instance, if you haven’t lived in a property you own for the past 10 years, or if you haven’t owned any property in over 3 years, you might still qualify.

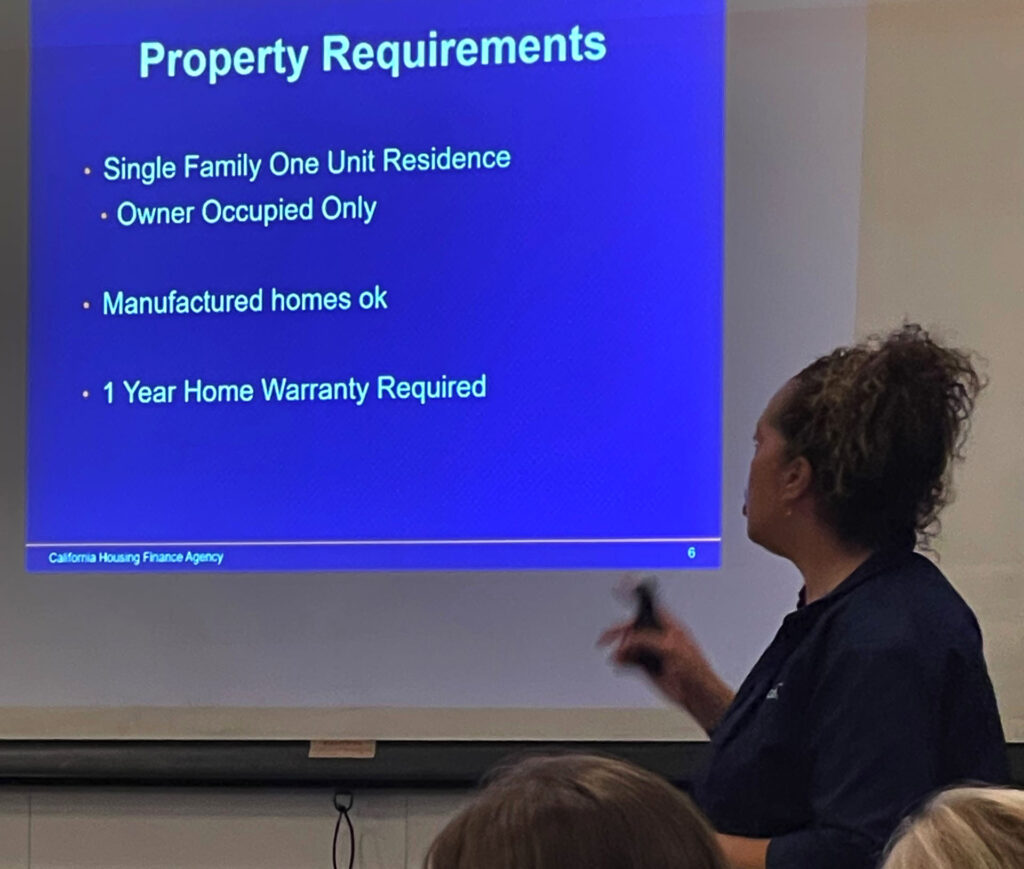

Now, let’s talk about the property itself. The house must meet specific requirements to be eligible for a CalHFA loan. It must be a single-family residence, although mobile homes do qualify. Additionally, properties with ADUs (Accessory Dwelling Units) can also be eligible if the tax records classify them as single-family residences. Another essential requirement is a Home Warranty at the time of closing, ensuring peace of mind for first-time homebuyers.

As we move into the new year, we’re excited to share that we have two more seminars planned. On January 24th, 2024, we’ll be in Santa Barbara County (location TBD), and on February 2nd, 2024, we’re coming to Oxnard (location TBD). We’re here to answer all your questions about these programs and guide you through the qualification and homebuying process. Feel free to reach out to us for all your real estate needs. Your dream home is closer than you think!

Stay tuned for more updates and valuable insights as we continue our journey toward making homeownership a reality for everyone.